- THE WORLD NEEDS 30-TRILLION OF STIMULUS TO CONTINUE IN THEIR SLEEP WALK.

- AND IF THIS MUCH IS INJECTED INTO 200-ECONOMIES AROUND THE WORLD, HYPERINFLATION MAY STRIKE.

- EARTH IS BOUNTIFUL WITHOUT CHECK POINTS. WHILE THE SOLUTION IS VERY SIMPLE WITH COMMON SENSE, IT DOES NOT SERVE IN THE INTEREST OF THE 1% INSIDER PUPPETS OF THE INVISIBLE DEEP STATE ENEMY.

- THE ANSWER IS, DECENTRALIZE AND RESTORE GOLD HARD CURRENCIES @ LOCAL TREASURIES, BUT AT THE COST OF THE FEDERAL RESERVE.

Goldman On Gold: "Time To Buy The Currency Of Last Resort"

A month ago, Goldman Sachs suggested there is more to come for precious metals as with rates getting closer to their lower bound, gold looks increasingly like the safest haven.

At the start of March, Goldman's head of commodity strategy said there is one commodity that will be safe: gold "which - unlike people and our economies - is immune to the virus."

And now, Jeffrey Currie and Mikhail Sprogis are saying The Fed's "open ended" QE reverses funding stresses and will offset the negative impact from lower EM demand:

"We are likely at an inflection point [for gold] where 'fear'-driven purchases will begin to dominate liquidity-driven selling pressure as it did in November 2008."

As such, Goldman raises both the near and long-term gold outlook, saying they are “far more constructive,” reaffirming their 12-month target of $1,800/oz .

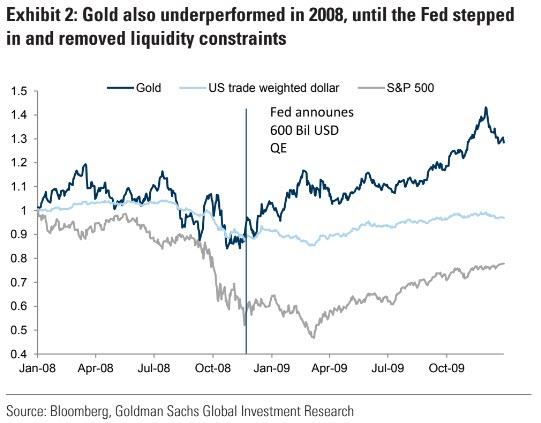

In 2008, the turning point for bullion was the announcement of $600b QE in November, after which gold began to climb despite further weakness in equities and commodities.

A similar pattern is emerging as gold prices stabilized over the past week and rallied as the Fed introduced new liquidity injection facilities.

Goldman's full note below:

1) We have long argued that gold is the currency of last resort, acting as a hedge against currency debasement when policy-makers act to accommodate shocks such as the one being experienced now.

So why has the gold price fallen? The answer is the world is short dollars.

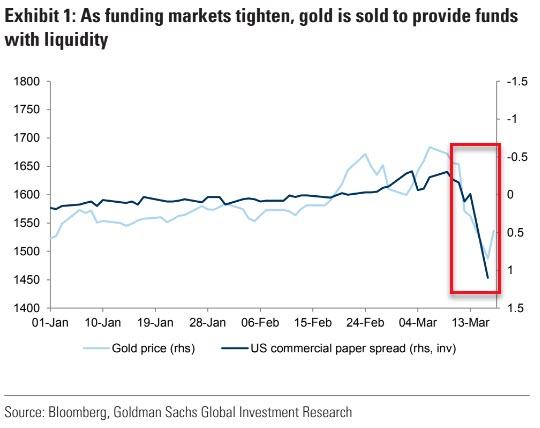

First, both physical and financial market participants face severe funding constraints; they have been forced to sell liquid positions which include gold and other commodities to generate dollars for other funding needs (see Exhibit 1).Second, large falls in the price of oil have created dollar shortages for emerging market (EM) economies. This has become particularly apparent with the Russian central bank in the past several weeks as the oil price decline shifted Russia from a net buyer of gold to a possible net seller.

We believe that yesterday’s announcement from the Fed for ‘open ended’ QE reverses these funding stresses and offsets the negative impact to EM wealth and are recommending buying December 2020 gold.

2) Gold has been severely impacted by liquidity issues, correcting by $120 (-7%) from its peak.

The situation resembles 2008, when gold also failed to act as safe-haven asset initially, falling by around 20% due to dollar strength and a run into cash. In 2008, the turning point was the announcement of $600bn QE in November, following which gold began to climb despite further weakness in equities and commodities (see Exhibit 2).

We are beginning to see a similar pattern emerge as gold prices stabilized over the past week and rallied the last two days as the Fed introduced new liquidity injection facilities with this morning’s announcement.

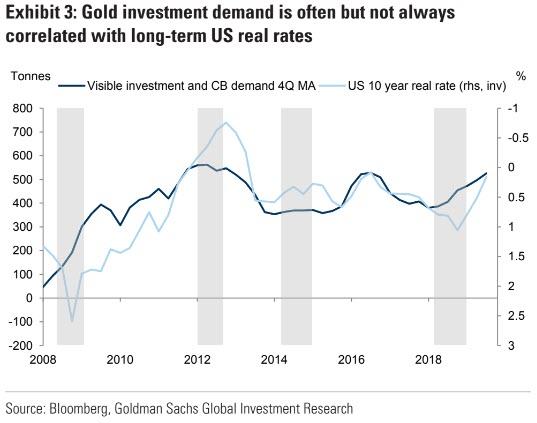

3) We analyze gold through the prism of our ‘Fear and Wealth’ framework, where ‘Fear’ of currency debasement is the primary driver of developed market (DM) investment demand while ‘Wealth’ is the primary driver of EM purchases.

Debasement ‘Fear’ is often, but not al ways , correlated with US long-term real rates (see Exhibit 3).

With funding stresses likely eased, focus will likely shift to the large size of the Fed balance sheet expansion, increase in fiscal deficits in DM economies as well as issues around the sustainability of the European monetary union.

We believe this will likely lead to debasement concerns similar to the post GFC period. Accordingly, we are likely at an inflection point where ‘Fear’-driven purchases will begin to dominate liquidity-driven selling pressure as it did in November 2008. As such, both the near-term and long-term gold outlook are looking far more constructive, and we are increasingly confident in our 12-month target of $1800/toz .

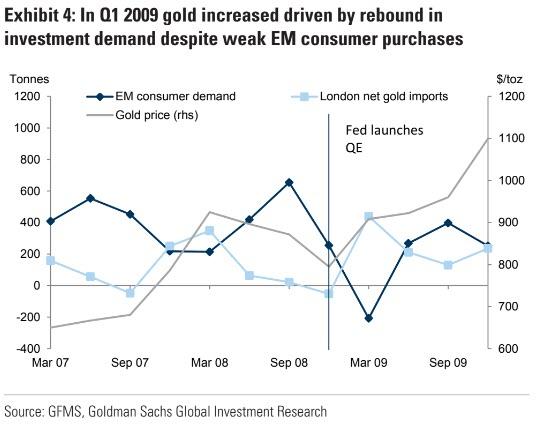

4) While ‘Wealth’ is likely to continue to be a headwind for gold, particularly in the near term as oil prices, EM growth and EM currencies remain under pressure, China and other parts of Asia are showing reassuring signs of recovery.

Last week we reduced our 6-month gold price target by $50/toz to $1700/toz to reflect the impact of lower EM ‘Wealth’, and we believe this has already been reflected in current gold pricing. Continuing to draw on the 2008 parallel, we believe that the increase in ‘Fear’-driven investment demand is likely to trump the negative ‘Wealth’ shock in the near term (see Exhibit 4).

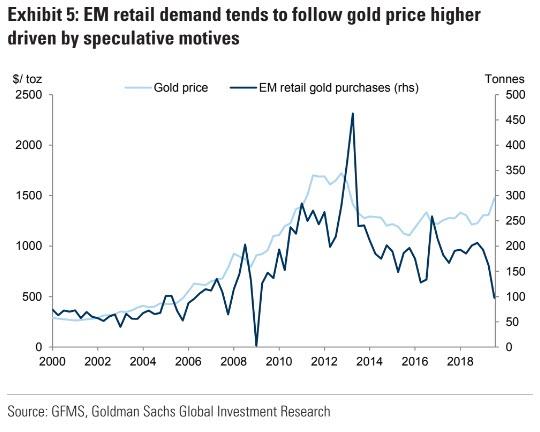

As gold demand can be deferred as opposed to permanently lost like energy demand, we expect as Asian EM economies stabilize, EM gold demand will rebound strongly as consumers make up for missed purchases, particularly for speculative purposes as they have done in the past when chasing a trending market (see Exhibit 5).

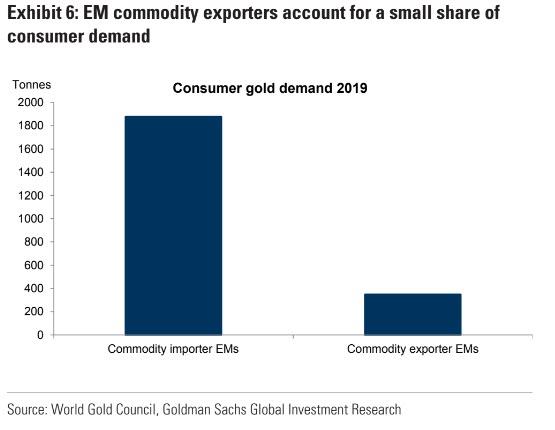

5) However, the wealth outlook for commodity-rich EMs is not as optimistic in the near term, but their demand for gold is not as large as that from the Asian EMs.

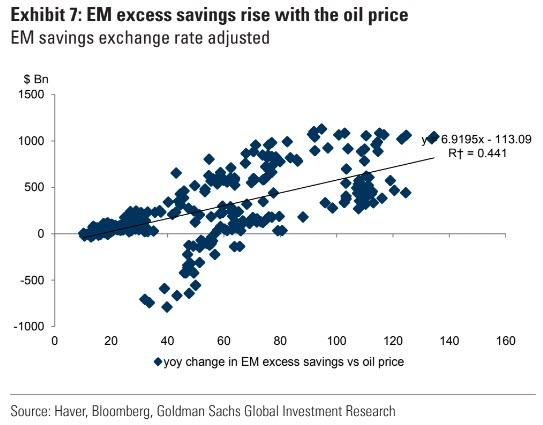

So while we are comfortable being long gold, it doesn’t mean that our FX strategists believe that the dollar shortages are behind us or that we would want to be long other commodities. As we have argued in the past, given the size of the global oil market, a drop in the oil price of recent magnitudes accentuates dollar shortages as oil and commodity prices are highly correlated with the accumulation and dissipation of EM excess savings (see Exhibit 7).

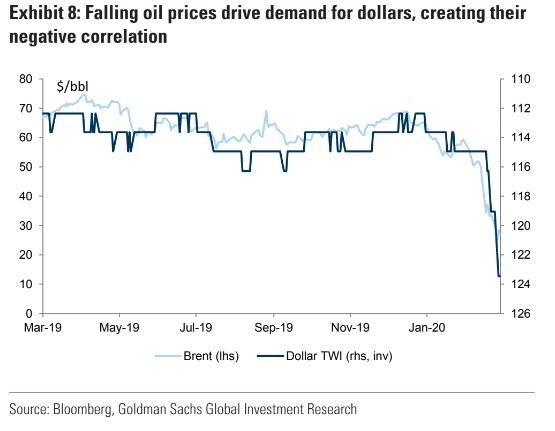

Financial markets normally transform these excess savings into greater global liquidity, supporting asset valuations and improving credit conditions globally. Hence, when weak commodity prices create a draw on EM savings they act as a drag on financial conditions and a headwind on gold prices as dollars become more scarce. Accordingly, the negative oil-dollar price correlation has been re-established (see Exhibit 8).

6) Ultimately, once their GDP stabilizes, EM consumers should help prolong the current ‘Fear’-driven bull market in gold.

Drawing one last parallel to 2008, while EM wealth continues to be under pressure due to the reasons cited above, once the COVID-19 crisis abates, we see potential for sequential improvement in Asian EM growth to lead DM out of the crisis as it did in 2008/09. This China-driven growth will likely give rise to inflationary concerns given the sharp expected contraction in oil and other commodity supply like agriculture and livestock. Combined with the fiscal nature of the current policy response to COVID-19, we believe physical inflationary concerns with the dollar starting near an all-time high will for once dominate financial asset inflation that was a feature of the past decade. Such inflationary concerns should further support gold prices as the currency of last resort.

* * *

So, Gold, which a WSJ "expert" idiotically called a "pet rock" back in 2015...

... is according to Goldman the last thing and only thing that might store value, namely "the currency of last resort and avoids the concern that paper currencies could be a medium of transfer for the virus. As a result, gold has outperformed other safe haven assets like the Japanese Yen or Swiss Franc" a trend Goldman sees continuing as long as uncertainty around the full impact of COVID-19 remains, which will be the case for a long time, and is also why gold is currently the best performing asset class YTD, a "once in a decade event" as the last time this happened was back in 2010.

https://dailycaller.com/2020/03/10/farrell-spygate-could-make-watergate-look-like-a-third-rate-burglary/📁

The key that opens all doors.

The 'Start'.

Q

The key that opens all doors.

The 'Start'.

Q

https://twitter.com/RepAndyHarrisMD/status/1242178705050480640📁

PREVENT [[D] party destruction] BY ANY MEANS NECESSARY.

These people are sick!

Nothing can stop what is coming.

Nothing.

Q

PREVENT [[D] party destruction] BY ANY MEANS NECESSARY.

These people are sick!

Nothing can stop what is coming.

Nothing.

Q

“the

Worth remembering:

https://www.youtube.com/watch?v=aeVrMniBjSc📁

Wuhan Institute of Virology [geo

[1st biosafety lvl 4 lab – 2015]

City/Province origin – hot zone [geo

https : opa pr harvard chinese related📁

“Unbeknownst to Harvard University beginning in 2011, Lieber became a “Strategic Scientist” at [Wuhan] University of Technology (WUT) in China and was a contractual participant in China’s Thousand Talents Plan from in or about 2012 to 2017.”

[rapid

https://www.theepochtimes.com/the-closing-of-21-million-cell-phone-accounts-in-china-may-suggest-a-high-ccp-virus-death-toll_3281291.html📁

>End POTUS rally(s)?

>End POTUSecon

>End POTUS unemployment gains?

>End POTUS [A, B, C, D, …

[weaken

>Delay US/China trade negotiations?

[Chinapref [

>Shelter [Biden] public appearances?

>Shelter [Biden] debate(s)?

>Push new/revised P_2020 > vote by mail?[ unsecure

https://twitter.com/TomFitton/status/1242071506445885441📁

>Push

https://twitter.com/SenTomCotton/status/1242169734763819011📁

What is the mathematical probability this occurs [the ‘time bomb’ explodes] at the exact point in time that allows for maximum damage [above] prior to the P_elec?

Outside of standard deviation?

WHO BENEFITS THE MOST?

[Mueller failed]

[Impeachment failed]

>Whywas it critically important impeachment be rushed in

[MSM[ ]

[THE COUP FAILED]

[D]party lock-down take-over [

Occam's razor simply states that of any given set of explanations for an event occurring, the simplest one is most likely the correct one.

Q

Worth remembering:

https://www.youtube.com/watch?v=aeVrMniBjSc📁

Wuhan Institute of Virology [

[1st biosafety lvl 4 lab – 2015]

City/Province origin – hot zone [

“Unbeknownst to Harvard University beginning in 2011, Lieber became a “Strategic Scientist” at [Wuhan] University of Technology (WUT) in China and was a contractual participant in China’s Thousand Talents Plan from in or about 2012 to 2017.”

[

https://www.theepochtimes.com/the-closing-of-21-million-cell-phone-accounts-in-china-may-suggest-a-high-ccp-virus-death-toll_3281291.html📁

>End POTUS rally(s)?

>End POTUS

>End POTUS unemployment gains?

>End POTUS [A, B, C, D,

[

>Delay US/China trade negotiations?

[China

>Shelter [Biden] public appearances?

>Shelter [Biden] debate(s)?

>Push new/revised P_2020 > vote by mail?

https://twitter.com/TomFitton/status/1242071506445885441📁

>

https://twitter.com/SenTomCotton/status/1242169734763819011📁

What is the mathematical probability this occurs [the ‘time bomb’ explodes] at the exact point in time that allows for maximum damage [above] prior to the P_elec?

Outside of standard deviation?

WHO BENEFITS THE MOST?

[Mueller failed]

[Impeachment failed]

>Why

[MSM

[THE COUP FAILED]

[D]

Occam's razor simply states that of any given set of explanations for an event occurring, the simplest one is most likely the correct one.

Q

https://www.youtube.com/watch?v=_MK0j765ko4📁

Do not fear.

Q

Do not fear.

Q

https://twitter.com/RainbowFairy12/status/1236943098103713793📁

+comments

Per MSM [Fake News]:

(person ( ed imageboard ( ed

Logical thinking.

Backchannels

WWG1WGA!!!

Q

+comments

Per MSM [Fake News]:

(

Logical thinking.

WWG1WGA!!!

Q

No comments:

Post a Comment